25 Mar 2021

By Craig Hemke, Sprott Money:

For the past ten years, we’ve railed against the Bullion Bank fractional reserve and digital derivative pricing scheme. The solution has always been the removal of physical metal from the hands of the Banks and the Mints. Are we finally making some progress?

Before we begin, it is crucial that you understand this basic point: The globally recognized prices of gold and silver are not determined through the exchange of actual physical metal. Price is instead determined by the exchange of derivative contracts. Thus, the supply and demand of physical metal has very little day-to-day bearing on the derivative price. Instead, it is the supply and demand of the derivative itself that determines price.

About four years ago, I wrote the article linked below with the purpose of explaining, in as simple terms as possible, how and why this digital derivative pricing scheme benefits The Bullion Banks that have monopolistic control of these “markets”. If you’ve never read this post, please do so now:

The key pillars in maintaining this fraudulent pricing scheme are the market activities in New York and London. The CME-owned COMEX and the LBMA collective work together to manage price and the flow of physical metal that is needed to legitimize it. To understand this hand-in-glove approach, consider that Michael Nowak—the recently indicted former head of global precious metals trading for JPMorgan—also sat on the board of directors of the LBMA:

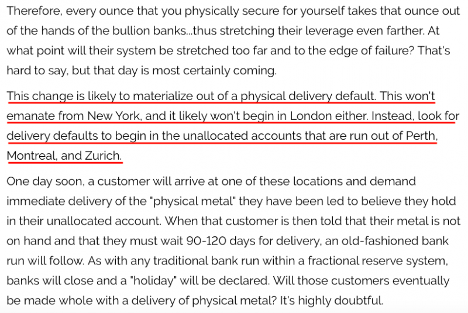

For precious metal investors everywhere, it is vital that we one day force this pricing scheme to collapse. Since The Scheme is built upon leverage and hypothecation, the only way we can win this fight is if we can force a deleverage of the fractional reserve system. However, The Bullion Banks work closely with the exchanges and the regulators to control and amend the rules and margin requirements whenever necessary. As such, default is unlikely to begin on COMEX or in London. Instead, the best hope for fracturing The System has always been the exposure of the unallocated and fractional reserve account schemes that exist on the margins.

We wrote about this subject back when the #SilverSqueeze movement began in February. If you missed that post last month, I’ll re-link it here with the key snippet pasted below: Groundhog Day for Silver Investors

Remember, an unallocated and fractional reserve system is precisely how your local fiat bank runs its business. All deposits are not held in the vault. Instead, the bank may hold 10% or so of its assets for “deposit demands” and it loans out the rest. This system profits the bank, and it works just fine—until it doesn’t, and the day comes when multiple customers show up at the same time and demand their cash. In the old days, it was called a “bank run”. In 2021, it’s called a #SilverSqueeze. In the clip below, don’t think of George Bailey. Instead, think of R.G. Hayes or Bart Kitner.

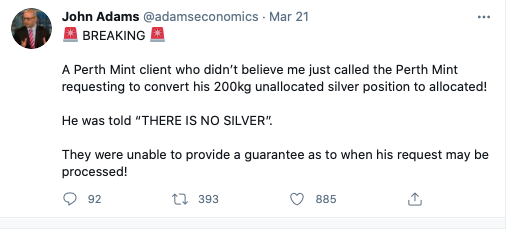

And the good news is…all of the recent physical metal demand seems to be driving some cracks in the system. Here are just a few notable items:

BREAKING

So, are we making progress?

YES!

Is it possible that a default on unallocated contracts could eventually expose and bring down the entire Fractional Reserve and Digital Derivative Pricing Scheme?

YES!

But we MUST keep up the pressure. Only a forced deleverage through the removal of metal from dirty Bullion Bank hands can make this happen. Therefore, anyone interested in free and fair price discovery must continue to stack physical metal and demand immediate delivery.

Just as important, however, is the continued demand of immediate delivery from unallocated accounts. First of all, if you personally hold metal in an unallocated account, get it out NOW. The last thing you want is to be at the back of the line with all of the other fools caught flat-footed and left wanting.

Next, spread the word. Tell your friends and anyone you know who is in the unfortunate position of holding unallocated metal to withdraw their metal from the system as soon as possible.

And then let’s see what happens next.

Remember, even if we don’t immediately force a change, deleverage of the system is coming eventually, regardless. In the meantime, any dollar or euro or pound you convert into precious metal serves the purpose of diversifying your portfolio out of fiat currency—and this is a good thing! But you might just force a change for good in the process.

Read more at the original source here: