From InvestingHaven:

The big silver rally stalled because speculators were unanimously long. The market does not reward consensus trades, the silver market will require less speculators before moving higher.

Silver experienced a solid bull run in the period March to May 2024. Right before hitting silver’s first bullish target of $34.70, the big silver rally 2024 stalled. Why? And for how long.

Just to be clear – Silver will hit $50 sooner or later, the question is when exactly.

It’s a matter of WHEN, not IF.

Consensus trades never end well, also not in silver

If anything, the market knows very well when the majority of participants are positioned in one direction.

Consensus trades never end well.

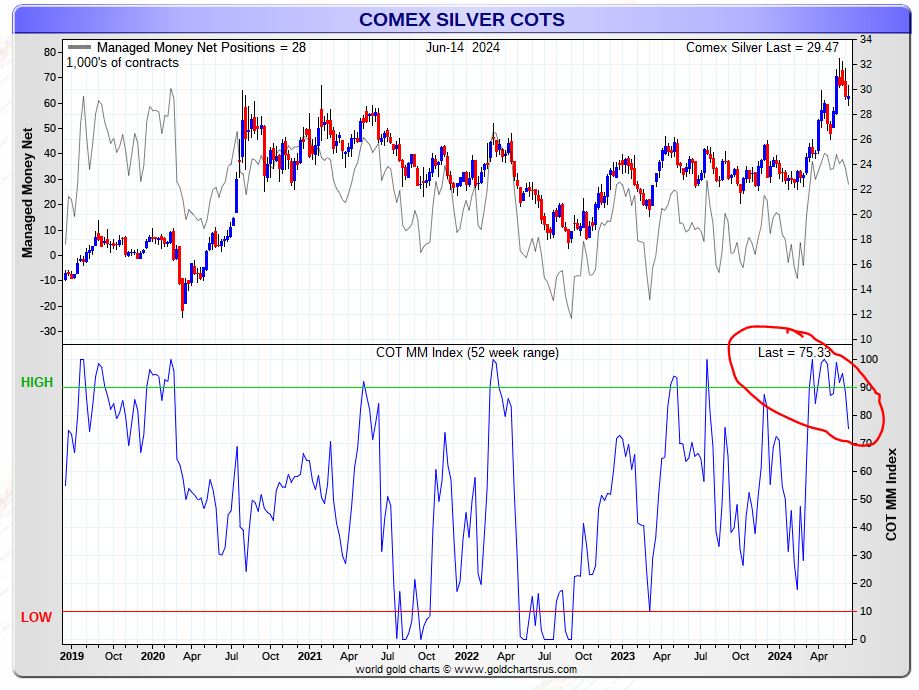

Silver experienced an excessive number of speculators betting on the long side, in the silver futures market. This, as said in our premium silver alerts since April, would prevent silver from moving much higher, in the short to medium term.

That’s exactly what happened. Consensus long positions in the silver market, especially by speculators, resulted in the big silver rally 2024 stalling.

The historic 2011 silver rally was without speculators’ participation

In our premium gold & silver report Silver – An Historic Analysis Of Turning Points (shared on June 1st, 2024, instantly available in our restricted research area) we explained the conditions during the historic 2011 silver rally.

One thing was clear – there was no consensus long setup among speculators.

While we strongly recommend to read more in the premium note, it suffices to say that speculators should not be too enthusiastic for a sustainable silver price rally to occur.

The 2011 silver price rally is one of the many illustrations of this market dynamic!

Silver speculators are giving up, a lovely development

This is what we wrote in this week’s premium silver alert:

Speculators finally are giving up, finally. They have been hit, undoubtedly, during those days with larger red candles. Remember, this is a futures market indicator, the leverage is insane when holding futures, so a 5% one-day decline has tremendous effects on a portfolio holding silver long futures.

The chart below, showing positioning of speculators in the silver futures market, makes the point. The red annotation is the % that really matters (h/o GoldChartsRUs.com).

On the question whether the big silver rally of 2024 can continue or not, we believe the answer is YES BUT NOT YET. As explained in our premium silver alert:

It’s too early to get excited, but speculators leaving the arena is the pre-requisite for silver to move higher. Lovely development, likely just the beginning, there will be a point in a few months where speculators will be hating silver which is when we’ll love it!

Ultimately, silver in 2024 may be stalling, but bullish continuation can reasonably expected later in 2024 (exact timing not clear yet) and certainly in 2025.

Read more at the original source here: